Due Diligence

There are many aspects to performing due diligence and, most significantly, defining the

objective of the exercise is the most critical. Due diligence is often thought of purely in conjunction

with acquisitions but it is also an extremely useful tool for reviews prior to other investments, spin offs,

operational reviews and business plan validations.

There are many aspects to performing due diligence and, most significantly, defining the

objective of the exercise is the most critical. Due diligence is often thought of purely in conjunction

with acquisitions but it is also an extremely useful tool for reviews prior to other investments, spin offs,

operational reviews and business plan validations.

For any due diligence to succeed, the key drivers must be identified and relative weightings given. For example with an acquisition the common drivers are:

- Purchasing a revenue stream/market share

- Expanding into a new geographical region

- Building a new line of business

- Acquiring key staff*

- Finding key assets (physical, Intellectual Property, etc.)

- Consolidation of businesses

* In the past acquisitions to gain pure technology or products where common - now with the speed of product development and technological changes most companies look for the teams that made the products/technology rather than the result of their work.

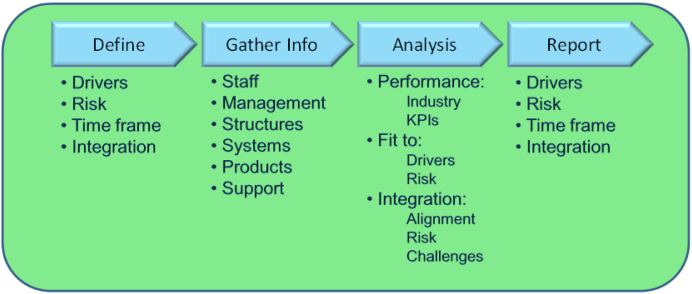

Methodology

The following methodology is used:

Services

- Please Contact MRD Global to discuss any particular requirements for your business.